Thesis

Applying the Co-opetition framework to the new Google-Roku standoff helps to explain why neither company is incentivized to cooperate towards a resolution, and why Roku’s “win-win” business logic may not be the best model for working with tech giants in streaming.

Research

On Friday, Roku’s third ugly public standoff since 2020 began after it followed through on its threat to remove streaming bundle YouTube TV from its platform.

The outcome seems surprising given the relative seamlessness of Roku’s recent deals with Amazon for The Roku Channel on Fire TV, and IMDb TV on the Roku Channel. I wrote about both in February in Member Mailing #252: Coopetition and Original Content Strategies in Streaming:

If there is any indication of how powerful Roku’s and Amazon’s positions are in the connected TV ad marketplace, it is how the announcements of The Roku Channel’s distribution on Amazon Fire TV last October, and IMDb TV’s distribution on Roku last month, emerged with little drama or fanfare.

In other words, if there was complexity within the negotiations - and there presumably was given that the IMDb TV announcement came three months after The Roku Channel announcement- that complexity was not enough for either party to default to public stand-offs around non-negotiable items like inventory sharing or third-party licensing. These two deals are true outcomes of Coopetition.

Coopetition or Co-opetition (the latter spelling better reflects the pronunciation) is a portmanteau of competition and cooperation, and is defined as “collaboration between business competitors, in the hope of mutually beneficial results”.

That Member Mailing highlighted how easy it was for Amazon and Roku to reach a deal despite being head-to-head competitors in the free AVOD space (Amazon’s IMDb TV vs. The Roku Channel), in the Connected TV ad space (Amazon Advertising vs. Roku Advertising) and in the TV device and OS space (Fire TV devices. Roku devices).

It has been comparatively difficult for both WarnerMedia and NBCU to reach deals with Roku and Amazon for their ad-supported apps (WarnerMedia’s HBO Max, NBCU’s Peacock) - both deals took ~8 months to reach - and NBCU remains in a standoff with Amazon over distributing Peacock.

Last week, Google and Roku each publicly told the marketplace that cooperation was not an option, and rather accused each other of being “anticompetitive” and of “bad faith”. Google told the marketplace in a YouTube blog post:

Despite our best efforts to come to an agreement in the best interests of our mutual users, Roku terminated our deal in bad faith amidst our negotiation. Unfortunately, Roku has often engaged in this tactic with other streaming providers.

And Roku shared in a statement to Deadline:

It is well past time for Google to embrace the principles that have made streaming so popular for millions of users by giving consumers control of their streaming experience, by embracing fair competition and by ceasing anticompetitive practices. We believe consumers stand to benefit from Google and Roku reaching a fair agreement that preserves these principles and we remain committed to trying to achieve that goal.

There are multiple moving pieces to the negotiations, and you can get a thorough picture from these three pieces:

- Deadline’s Dade Hayes, “Roku Removes YouTube TV From Channel Store Over “Anti-Competitive Practices”; YouTube Decries “Bad-Faith Termination” Of Deal – Update”

- Axios’ Sara Fischer, “Roku says it may lose YouTube TV app after Google made anti-competitive demands”

- Protocol’s Janko Roetggers, “What Roku and Google are fighting about: Video codecs, voice search and millions of eyeballs”

It is worth revisiting the Co-opetition framework as a helpful, additional lens here. Roku “has characterized [the dispute] as more about principle than dollars.” But I don’t think that’s entirely accurate: co-opetition is about two competitors both realizing that there are more incentives to cooperate than to compete. The problem here is neither company is incentivized to cooperate.

Roku is particularly unhappy that Google has been leveraging the negotiations to force an upgrade to the AV1 codec, an open-source video codec that promises better-looking 4K videos at lower bitrates (basically, more efficient streaming). Roku is telling the marketplace that it is not incentivized to pass on to consumers the additional costs that AV1 codec would require, but it would be more incentivized to do so if Google would agree to change the terms of its separate YouTube deal with Roku.

Google is saying it is not incentivized to revisit those terms.

There is a big competitive reason why: YouTube is the second most popular app on most smart TV platforms, reaching 120MM people in the U.S. per month who watch it on their TV screens. That is more than 2x the size of The Roku Channel, which has 51.2MM monthly active users, the majority of which are in the U.S. Back-of-the-napkin math tells us almost 100% of Roku Monthly Active Users use the YouTube app.

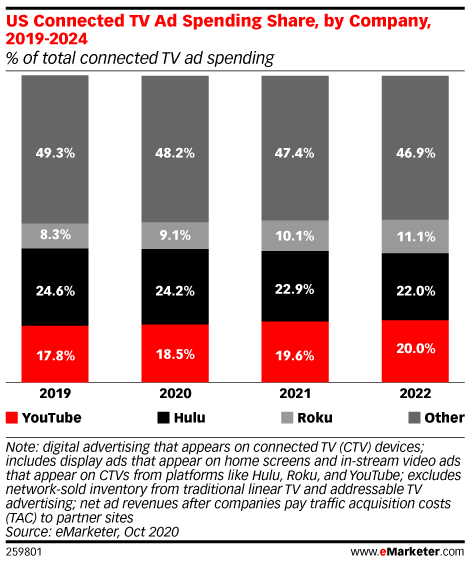

YouTube’s connected TV ad-serving software also competes with Roku’s emerging and growing connected TV ad-tech platform.

YouTube TV is the only exception: it is a vMVPD with 3MM+ subscribers, and Roku does not offer a vMVPD. So, there is no competition in the vMVPD space. So, in theory there should be a deal for YouTube TV already - there are no incentives to compete in vMVPD and therefore plenty of opportunities for both Roku and Google to cooperate here.

Instead, what makes this standoff interesting is how Google is leveraging these negotiations to exploit Roku’s win-win business logic, as Roku SVP Scott Rosenberg told CNBC’s Alex Sherman last July ($ - paywalled):

So the best, winning recipe is a model, an economic relationship between the parties where we’re both winning, we’re both earning as we drive the success of these apps. That’s what we seek and ultimately, in some cases, it takes us a little longer to get there with the parties

It is a jiu-jitsu-type move, leveraging YouTube’s scale as a means of breaking Roku via Roku’s “win-win” business terms. So, in this light, Google is saying “the success of YouTube apps on Roku needs the AV1 codec, and YouTube users need a better user experience on Roku ”. Roku finds both requests problematic, but both requests are necessary for the YouTube apps succeeding within the Roku ecosystem (Roku “commanded 37% of big screen viewing time in Q1 2021”, according to Conviva’s State of Streaming Q1 2021 report).

This ends up being a funhouse mirror version of co-opetition: Google is working within Roku’s “win-win” parameters of the partnership but its definition of “success” for YouTube and YouTube is costly for Roku. For Roku to also benefit from its partnership with Google, it is being asked to make costly decisions given those are the decisions that YouTube requires at its greater scale.

That puts Roku in an unenviable but logical position, given how its business relies on the success of its partners. Through the lens of co-opetition, the problem between Google and Roku simply may be that what YouTube needs to succeed is costly to Roku because that’s what a win-win outcome requires.

I don’t know if that is “anti-competitive” or “bad faith”. I do wonder if Roku’s “win-win” business logic may not be the best model for working with tech giants in streaming (excluding Netflix which Roku spun out of in 2007).